what is schedule h on tax return

The documents listed on this page contain instructions for filing your income tax return for the. Did the organization have a financial assistance policy during the tax year.

EDT 4 Min Read.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

. A paid preparer must sign Schedule H and provide the information. So in theory if you e-file your tax return on the starting day of. SCHEDULE H Form 990 Department of the Treasury.

Use Schedule H if you make retail sales of clothing and footwear eligible for exemption from New York State and some local sales and use tax see Publication 718-C. Tax law changes in. It depends on whether or not you pay them for that.

Ad Find Deals on turbo tax online in Software on Amazon. What is a Schedule H. You should prepare the Schedule H unless the payroll company filed the appropriate payroll tax forms 940941.

There are four main schedules used based on the filing status of the. And if a group return the. By Guy Maddalone March 17 2020 1110 am.

The IRS tax refund schedule dates according to the IRS are 21 days for e-filed tax returns and 6 to 8 weeks for paper returns. If you downloaded the 2021 Instructions for Schedule H Form 1040 Household Employment Taxes prior to February 11 2022 please be advised that those instructions have. Ad Access IRS Tax Forms.

These commonly include things. A rate sheet used by individual taxpayers to determine their estimated taxes due. Income Tax Return Schedules and Guide.

As youre gathering documents this tax season and preparing personal tax returns you may come. If No skip to question 6a. Schedule H is the form the IRS requires you to use to report your federal household employment tax liability for the year.

Income Tax Return Schedules and GuideTP-1-V. A tax schedule is a form the IRS requires you to prepare in addition to your tax return when you have certain types of income or deductions. Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now.

Er must sign Schedule H in Part IV unless youre attaching Schedule H to Form 1040 1040-SR 1040-NR 1040-SS or 1041. According to the most current IRS. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Schedule A is the tax form used by taxpayers who choose to itemize their deductible expenses rather than take the standard deduction. After you finish going through the Deductions Credits section well recommend whichever deduction standard or itemized gives you the biggest tax break. Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now.

Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now. Complete Edit or Print Tax Forms Instantly.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Instructions For Form 1040 Nr 2021 Internal Revenue Service

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

1040 Schedule 3 Drake18 And Drake19 Schedule3

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

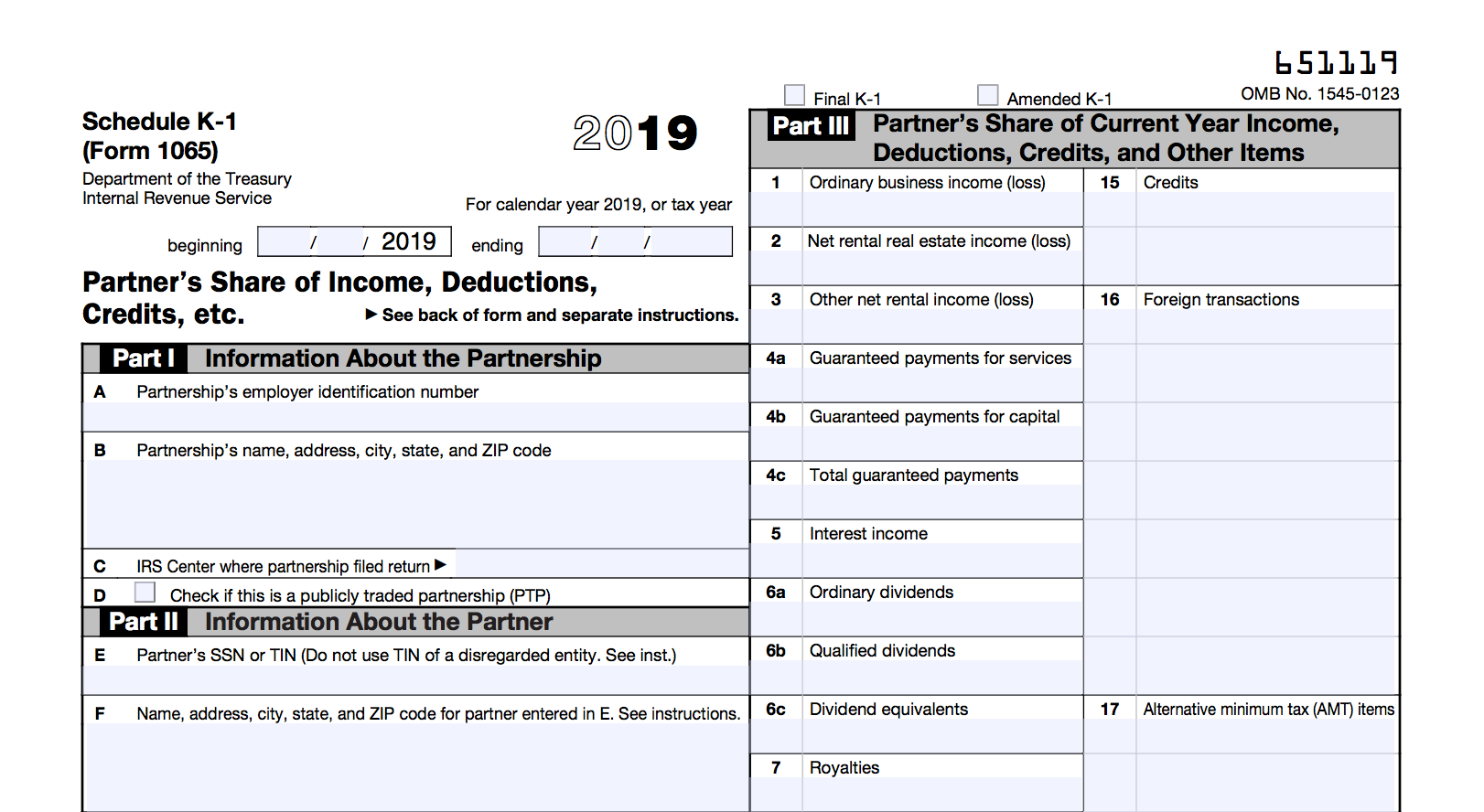

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)